Amphlett Lissimore is committed to providing the very best legal services

Advice to individuals and businesses in South London and beyond. Our lawyers are specialists in their areas of law, with the local knowledge that our community needs.

Request a Callback

Who we are

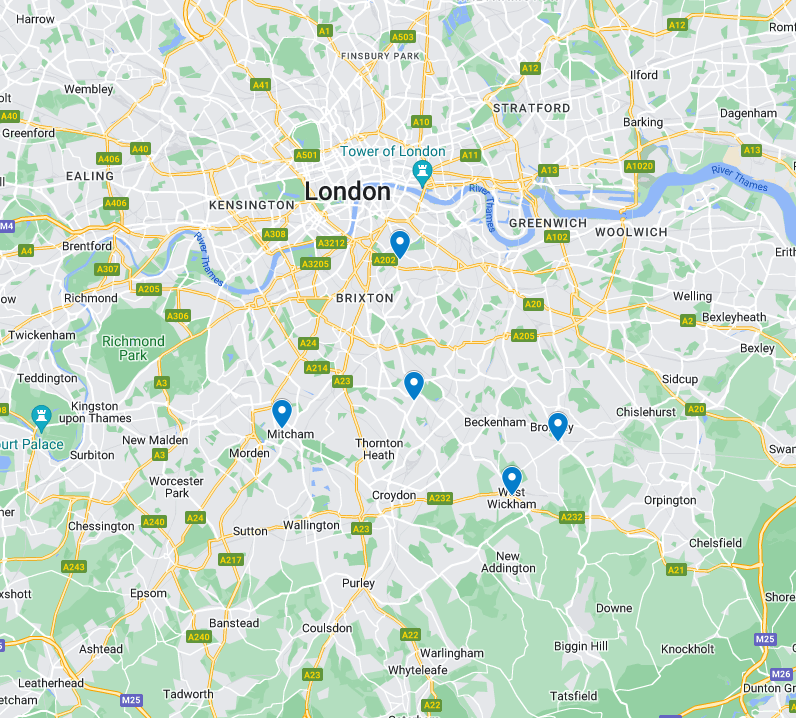

Amphlett Lissimore is your local law firm with 10 offices in and around South London.

We provide the full range of services you’d expect from a high street law firm, including specialisms in conveyancing, family law, wills & probate, and leasehold enfranchisement.

We’re committed to excellence. We understand that lawyers exist mainly for life’s less pleasant moments, and we care about giving you an efficient, effective service that won’t add to the stress. We only do what we’re good at. We won’t waste your time dabbling in work we know nothing about.

Services for you

Services for business

Free Initial Assessment

Have you ever wanted to just ask a lawyer if they can help you, without worrying about what it may cost to contact them? If so, call us and together we can work out what your next steps might be…

Same day response

We promise to acknowledge your enquiry the very same day. We will also let you know when you can expect a more detailed reply. Of course, if it is a simple enquiry which we can answer the very same day, we will.

Direct Lawyer Contact

With us, you’ll always find our lawyers are friendly and approachable. That’s why we promise you that as our client, you will always be given the direct phone and email details of your lawyer – making it easy to get in touch.

Featured Client Testimonial

"Excellent service, I couldn't have asked for better. They never took more than a day to reply to any of my emails and were always helpful when they did so."

Joshua

What our clients say

Our Offices

We are your local London solicitors. Our head office is in the heart of Crystal Palace in Upper Norwood, with offices across South London including Bromley, West Wickham, Battersea, Camberwell, Richmond, London Bridge, and Mitcham.

News & Blogs

Latest News