Lasting Power of Attorney vs Will: What’s the Difference and Do You Need Both?

It’s a common misconception that if you have a will in place, you don’t need a Lasting Power of Attorney (LPA). However, a will only takes effect after your death, whereas an LPA protects you during your lifetime.

If you fall ill or suffer an injury that means you’re unable to make health and financial decisions for yourself, no-one – not even your family – can step in, but an LPA allows you to appoint trusted individuals to make those all-important decisions on your behalf.

This article explores the differences between wills and LPAs, including when each takes effect and how each relates to healthcare and finances. Read on to determine why a will alone is not enough.

What is a Will?

A will (or last will and testament) is a legal document that details what should be done with someone’s money and property after their death. Its purpose is to protect your interests and ensure your estate is distributed according to your wishes after you die.

A will allows you to appoint an executor to manage the entire process and ultimately protect your legacy. You can name guardians for minor children and ensure your assets are shared between friends, family and charities rather than according to laws that take effect when there is no will (intestacy).

Intestacy laws dictate asset distribution, prioritising a spouse or civil partner and any children. Unmarried partners Inherit nothing automatically.

What is a Lasting Power of Attorney (LPA)?

An LPA is a legal document that specifies who will make decisions on someone’s behalf in the event that they lack the capacity to make them. Its purpose is to allow you to nominate a trusted individual to manage your affairs if illness or injury prevents you from doing so.

The person the LPA is set up for is the donor, and their trusted person is known as an attorney. An LPA applies during a person’s lifetime and ceases to be effective on their death.

There are two types of LPA:

Health and Welfare: this allows an attorney to make everyday decisions, such as those related to clothing, food and drink, as well as more important decisions, such as related to living arrangements and medical care.

This LPA can only be used when the donor lacks mental capacity to make the decisions themselves.

Property and Financial Matters: this allows an attorney to manage financial tasks – from simple duties such as paying bills, to more complex decisions such as selling property or shares.

A donor can choose when this LPA takes effect: either when mental capacity is lost, or as soon as the LPA is registered.

Key Differences: LPA vs Will

Wills and LPAs differ significantly in terms of their purpose, timing and authority. The following comparison table highlights the main differences.

| Feature | Will | Lasting Power of Attorney |

|---|---|---|

| Takes effect | After death | During your lifetime |

| Covers | Distribution of estate | Financial & health decisions |

| Works if you lose capacity | No | Yes |

| Avoids court involvement | No | Yes |

| Can be changed | Yes (while alive & capable) | Yes (while capable) |

Do you Need Both a Will and an LPA?

When it comes to wills and LPAs, one document does not replace the other. They have entirely different purposes and operate at completely different times: essentially, an LPA takes care of your affairs while you’re alive, and a will manages your estate after your death.

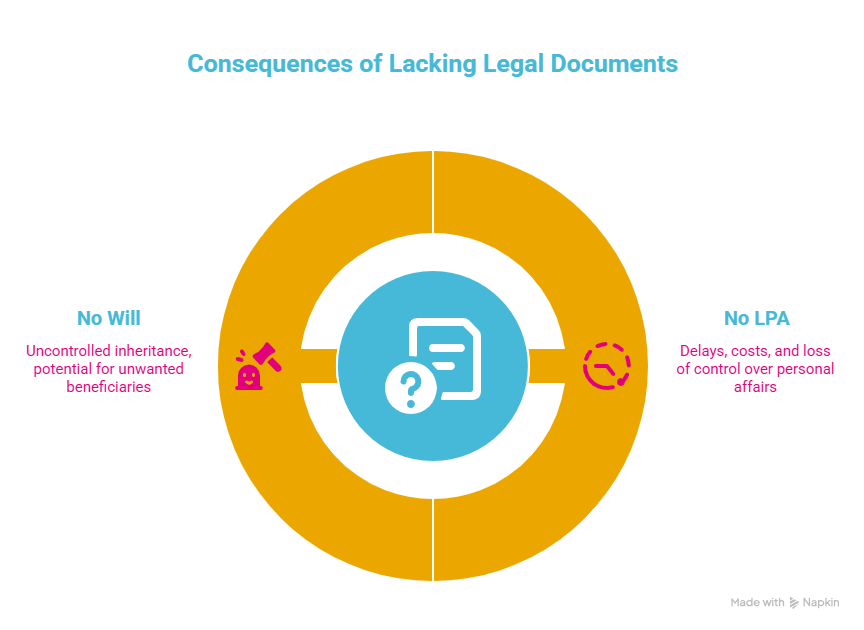

There are real-world implications to having only one, including loss of control and financial issues. Comprehensive planning involves having both an LPA and will in place, protecting your future and the people that matter to you – without either one, you are only partially protecting your interests.

What Happens If You Only Have One?

Will but no LPA

If you lose mental capacity while you’re alive, your family and friends have no automatic right to intervene in matters related to your finances or health. In this case, someone wishing to act on your behalf must appeal to the Court of Protection to become a ‘deputy’. Like LPAs, there are two types of deputy: personal welfare, and property and financial affairs.

The key consequences of not having an LPA are:

- Delays: Deputies, similarly to attorneys, must act in good faith, within the confines of the law, and in the best interests of the person for whom they are acting. The Court of Protection will determine if the person making the application is suitable to act as your deputy; this application to the Court of Protection can take several months to complete.

- Costs: The cost of professionally drafting a deputyship application typically outweighs the cost of preparing an LPA in advance, sometimes by thousands of pounds. There are also ongoing fees you should consider: court-appointed deputies often must pay ongoing fees to the Office of Public Guardian, and professional deputies, such as solicitors, can also charge significantly for their time. Delays in accessing funds could result in a detrimental lack of care or costly emergency procedures, meaning your condition could deteriorate.

- Loss of Control: Arguably, the biggest impact of not having an LPA is the total loss of control over who manages your affairs and makes decisions regarding your wellbeing – the Court of Protection may assign you a deputy, and it may not be a person you would have chosen.

The authority granted by an LPA is typically more flexible than that for an appointed deputy, who has to follow strict court guidelines. Your ability to shape how you live if you become incapacitated is lost without an LPA.

LPA but no Will

Intestacy rules come into effect if someone dies without a living will. These guidelines typically mean that a spouse will receive personal possessions, the first £322,000 and half of the rest; the remaining half is split between any children.

If you don’t draft a will, you have no control over who receives your money, property or possessions, meaning someone you didn’t want to benefit may inherit part of your estate, or your desired beneficiary may end up with nothing.

Unmarried partners and their families face great risks. A cohabitee doesn’t typically inherit anything under intestacy rules; the estate is distributed between blood relatives.

Your unmarried partner can claim for financial provision under the Inheritance Act; however this is an often stressful and expensive process. Your partner must meet one or both of the following criteria:

- They were living with you for at least 2 years immediately before your death

- They were financially dependent on you

Note that even if you wanted your partner to inherit all or part of your estate, blood relatives can still claim their statutory share.

Common Misconceptions

There are a number of misconceptions surrounding LPAs and Wills. Here are the most common.

‘I’m too Young for an LPA’

Future planning isn’t just for older people – life is unpredictable, regardless of age, and illness or injury can strike at any time No matter your stage in life, forward planning offers peace of mind and control over how your affairs are managed. An LPA protects you and your estate should you become incapacitated and unable to make decisions for yourself.

‘My Spouse can Automatically Act for Me’

Many couples assume that being married or in a civil partnership means they don’t need a will or LPA. But this isn’t always the case: your assets may not go where you expect them to, and without an LPA, your partner may not be able to make financial or health-related decisions for you. Having both in place ensures you are looking after each other for the future.

‘I Can do it Later’

Delaying the creation of an LPA or a will can have significant legal, financial and emotional risks, the core issue being that if you become incapacitated or die, you have no say over who makes decisions for you and who inherits from your estate. Full control is transferred to the courts without these legal documents.

How a Will and LPA Work Together

Holistic estate planning

Combining a will and an LPA is holistic future planning, providing you with comprehensive control and making sure that your wishes are carried out. Both documents form part of the same process: ensuring you and your loved ones are cared and provided for, now and in the future.

Peace of mind and reduced family stress

Having both an LPA and a will provides you with peace of mind; you can be assured that your chosen friends, family and charities will benefit from your estate after you are gone and that your trusted attorneys will be the only ones making decisions for you if you become unable to make them for yourself.

For your family and friends, both documents being in place means less stress – losing you, whether mentally or physically, would be difficult enough without the worry of who is sorting your affairs or who receives what from the estate.

Why they should be reviewed together

Combined reviewing of a will and an LPA is important as they are complementary documents for the same process: protecting you, your family and your assets.

Although not a mandatory requirement, your trusted LPA attorney and your will executor should ideally be the same person, for continuity, ease and, most importantly, your peace of mind – knowing that your trusted persons are the ones looking out for you, both in life and after death.

To avoid conflicts, your will and LPA should be reviewed together after a significant change in circumstances, such as divorce, death of a beneficiary, or a relationship change with an executor.

Why Both an LPA and Will are Essential

As you have seen, having both an LPA and a will is vital to protect yourself, your family and your estate. Sacrificing one document for the other means only partial protection.

You have the right to dictate how your affairs are managed both in life and after your death. Having neither or only one document puts your wishes at risk and can cause extra stress for or conflicts between your loved ones.

Although it’s possible to arrange these documents yourself, enlisting the help of a solicitor or professional will writer will ensure that they are legally watertight. Expert professionals can also guide you through your options and explain each stage of the process.

Protect yourself and your loved ones today by ensuring you have both a will and an LPA in place, and remember to regularly review any existing arrangements.